My Financial Journey

My relationship with money

The Tough Years 2016 - 2019

During a family visit to New Zealand (NZ) Dad casually asked,

“How are you doing financially?”…….“Not good” I replied.

We owed around $11,000 on our credit card, it weighed heavily on me. “Do you need help?” “No thanks.” I put us here, it was my responsibility to find a way out.

I am blessed to have parents that worked hard and saved. They did not come from money. One of my favourite childhood memories was the small bag of chips we choose in the weekly shop. My brother and I would weigh up the pros and cons of our available choices in the chippy isle.

Dad told us (as adults) the excess money in their weekly budget was those 2 packets of chips.

That’s a credit to my parents, we had no idea how tight things were. We had everything we needed growing up.

Had we been financially irresponsible? Yes but it wasn’t silly consumer debt. It was childcare fees combined with high rent .

Childcare was a dilemma. If we withdrew the boys they would lose their place, it took years to get a placement. Rach would eventually return to work, we needed childcare. We reduced their days to the minimum allowed but it did little to reduce our financial stress. Even with Rach back at work our incomes did not cover our two biggest expenses.

Before our second child money was tight but now we were in the red. Without savings to fall back on the credit card was heavily used. It was hard to get ahead, if we made extra credit card payments we would inevitably use more credit later. I felt like a slave to our debt. I never wanted to be in that position again.

My financial upbringing

School taught us nothing about understanding finances. How is a budget is not considered education?

What about my parents? My parents taught me valuable lessons.

Mowing Lawns

My friends started getting pocket money. My brother and I went to Dad to ask for a handout. Dad told us if we mowed the lawns (we had a push mower) he would give us 50 cents a week. We took turns mowing the lawn. Lesson 1: Work for Your Money.

Our old front yard, 50 cents a week to mow the front & back

Paper Boys

We were getting less pocket money than our friends. My brother and I went back to Dad. He increased our lawn mowing rate to 75 cents per week. He gave us advice which was far more valuable. “Get another job” Lesson 2: Increase Income

Mum got us jobs as paper boys delivering The Hutt News. Thanks Mum! She was the backbone behind the operation. She organised a bulk delivery of papers to the local Fish n Chips shop where she worked. She would help us pre-fold the papers with phamplets inside and sometimes helped with deliveries. Every week this shop was our base of operations. My brother and I would deliver papers then replenish our supply and repeat until done.

We had around 300 papers to deliver once a week, not an insignificant number. The money was pitiful but somehow I managed to save up $500 for a mountain bike!

Eventually we upgraded to the Evening Post, a paper delivered by the top tier of paper boys in the area. You didn’t just get this job. There was minimum age, waiting lists and interviews - serious stuff for a 14-15 year old. I was buzzing when they handed me that coveted yellow delivery satchel. We had to deliver papers to subscribers in our area before 6pm. Sometimes the paper would be late so we would peddle the wheels off our bikes to meet the deadline.

We had a precise number of papers which could change if subscriptions were put on hold. I took my responsibility seriously. I had a left over paper once. I was probably day dreaming and missed a house. I knocked on many doors until I found the the right house. My dedication and consistency didn’t go unnoticed. I was nominated for paper boy of the year. I won a runner up prize, a Tower Music gift voucher.

Having a good reputation meant other paper boys would ask me to cover their deliveries during holidays. I was always keen for extra cash!

Pay day was Thursday, we got $17.50 in a little brown paper envelope. I would cycle down to the local dairy thinking I was loaded and spend $2.50 on lollies (the coins in my pay packet). When the sun was out I felt on top of the world. Munching on lollies, money in my pocket, sun on my back…Life was good! Once a month I splurged on a collectable magazine called The Ancestral Trail for about $5.50. The rest I would save for toys or playing arcade games.

The Top Hat Dairy where I exchanged my $2.50 for lollies

Deka

A few years later I was working in Deka (a retail chain). Two young ladies had taken a shining to me and nicknamed me “Bum boy” Why? I did all the crappy tasks no one else wanted to do. I didn’t care, I got $28 for my Saturday shift a step up from my paper run. If you’re wondering I wasn’t bullied, they were fun to work with.

My main duties were vacuuming the store, doing the dishes and collecting coat hangers from the check outs. Once I completed those tasks I did anything the manager on duty told me too. I remember one odd job cleaning grafiti from the outside of the store. One job I hated was sorting through boxes and boxes of coat hangers. I organised them into piles and hung them up on racks over three or four Saturday shifts. Words cannot express how mind numbing that task was.

Dad inadvertently taught me another lesson. Lesson 3: Stick with it. One manager made my shifts miserable at Deka, I started to question if the money was worth it. I told Dad I wanted to quit but he told me to stick with it. So I did and I am better for it. To be fair to Pops I didn’t tell him what happened at work, just that I wanted to quit.

Financing a Motorbike

This was a self learned lesson.

Fast forward, I was about 26 working at IBM. Disposable income was high, I was living with my parents. I had graduated to a full motorcycle license after a year on my 1989 Honda CBR250RR.

I wanted a brand new 2006 Kawasaki ZX6R but didn’t have enough cash saved. I applied for finance and was surprised how easy it was. I loved that bike and popped my wheelie cherry on it!!

Then the financial commitment kicked in. I hated that part of my pay check was accounted for every month. Unfortunately or maybe fortunately (in terms of financial lessons) I crashed that bike and received an insurance pay out. I used the money to pay the loan back and avoided financing toys. Lesson 4: Avoid finance if possible

Dad always said, “Having money gives you options.” He is right and now I understand what it means for me pragmatically. Dad also taught me to:

- Pay bills on time

- Save Money

Where I am going with this? My parents gave me solid fundamentals when it came to money. I never expected handouts and learned to work for money at a young age. I understood what it took to increase my income.

My parents never taught me about investing. Well that’s not true. Dad taught me about term deposits. It was the safe option he used to build up their wealth.

In my early 20s (still living at home) I decided an investment property was a good idea. I was pre-approved for a $100,000 mortgage and looked at a few properties. I decided it was too hard. I regret that decision. I should have persisted and sought out investment property advice.

My parents lessons combined with self learned lessons meant I was responsible with the little I had. The extent of my investing was dabbling with term deposits.

Getting out of Debt

So how did we climb out of debt? It was a combination of things. Oscar had about 5 months left in daycare before starting school. We knew having two children in daycare would not be permanent and needed to weather the self created financial storm.

Increasing our income helped. The year prior (2015) I started a new job which came with a pay increase (not enough to cover our expenses) and Restricted Stock Units. RSUs are allocated stocks or shares which vest at specific future dates. Amazon experienced growth that reflected in the stock price. When I started 1 stock = ~$400 USD, the last stock I sold traded for ~$2000 USD each. No I’m not a millionaire, my RSU allocation was modest in line with my relatively junior role.

My income increased again as I achieved a promotion along with more RSUs. Rach also returned to work which increased our household income.

When Oscar finished childcare we were back in the green…..just. We had to pay before and after school care but that was nothing compared to 5 full days at daycare. We started attacking our credit card debt and my RSUs helped with the final push.

It took a while but we dug ourselves out of debt. My financial IQ was still low. Things like an emergency fund were still foreign concepts to me.

Avoiding Wealth Killers

Moving to Sydney in 2008 I was overwhelmed with the wealth compared to NZ. Everyone seemed to drive nice cars, have nice clothes, own nice things. Money seemed abundant.

Cars

We needed a car in Sydney. Finance never crossed our minds. We purchased an old Hyundai Sonata for around $3000. It was a piece of crap but we could afford it.

One morning I arrived at work, a brand new VW Golf wagon was beaming in the car park. We had just merged offices with another team in the data centre. Someone asked if the Golf was mine. I laughed (so did he), when I told him my ride was the crappy old blue Hyundai Sonata outside (similar to the picture below). Looking back my colleagues had nice cars, we were on similar contractor wages. I assumed they had saved for their cars (some might have) but finance was most likely used.

After 2 years of ownership the car became unreliable and broke down a few times. We gave it to a wrecker. The guy apologised after he put it on the truck. He could only give me $50 dollars for it. I was like:

“Bro, you’re doing me a favour! Take it for free!”

He was stoked! He probably sold it to a scrap metal dealer for a few hundred dollars. I was happy to see it gone.

We’ve had 4 cars in Sydney:

- Hyundai Sonata ~2003

- Peugeot 307 ~2007

- VW Tiguan ~2013

- Volvo XC90 2018 (current car)

They were used cars and we paid cash. Along the way I also purchased a motorbike. A Suzuki GSXR 750. She always had me grinning from ear to ear on the way to work. I should be banned from riding as I crashed that bike too!

My pocket rocket!

Credit Cards

Granted we had racked up 11k in credit card debt but it wasn’t for silly consumer purchases. We tended to pay for things in cash wherever possible and still do. There might have been a month or two we carried balances but we tended to pay it off quickly.

Consumerism

Investing was a future Sander problem.

I was part of a consumer society. It wasn’t a conscious decision but I take responsibility for it. There was so much advertising and spending happening around us. It was easy to get swept up. My weak point was (still is) electronics, I was a sucker for gadgets, upgrading TVs etc.

Buying property in Sydney was never on the agenda, our long term plan was to settle in NZ. Property was another future Sander problem.

Having children didn’t change my mindset. Our disposable income naturally shrunk but I still splurged if I had extra money. One year I spent my bonus on Sonos speakers. We still use them, they work great. The old me would have upgraded already but the new me will sweat them until they break!

The same consumer mentality followed me in other aspects of life. As our income increased the properties we rented were bigger or nicer. I now know this is called lifestyle creep. Thankfully debt never funded our lifestyle but there wasn’t much left over to save or invest. Not that it mattered I would have spent it anyway.

What changed?

The start of my investment journey was triggered by maturity. Fast forward to 2021-2022 and we were a family of five living in a large house in a good suburb. Rent was expensive on a single income but we could afford it thanks to salary increases in recent years.

The responsibility of a family drove me to create a detailed budget. Visualising our income and expenses put a spotlight on our bad spending habits. We started to cut excess spending.

The numbers did not stack up. We were on the edge of making ends meet. My monthly commission payments (extra income) pulled us through. I developed an itch, what if we could save every commission payment?

Cutting small expenses yielded small gains. We needed to cut a big expense like rent. It took a while to find a rental that satisfied our criteria (I may have dragged Rach to a few inspections). I low balled agents hoping the landlord might be desperate. The joke was on me. The rental market favours landlords as demand is greater than available properties in Sydney.

Eventually we found a place 20 minutes further north. Best financial decision we made. We freed up $350 a week, $1516 a month, $18,200 a year post taxes.

Increasing my Financial IQ

Work was going well, I got a promotion which included a pay increase and RSUs. I was in uncharted waters. Our budget was running in a healthy surplus.

I knew we needed to make our money work for us. Outside of term deposits I didn’t know much about investing.

I started watching Youtube finance content and reading finance books. I questioned the information I consumed and supplemented it with my own research. There was no need to rush. There are no get rich quick schemes.

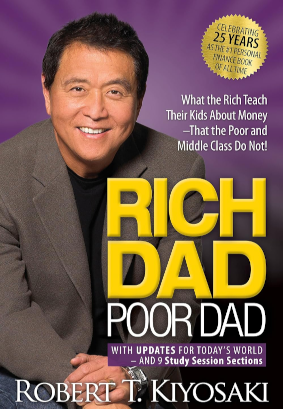

I read Rich Dad Poor Dad by Robert Kiyosaki. Loved it.

I should have read this book years ago when looking at investment properties. I learned a lot but I took away two things:

Your House is not an Asset

I agree with Robert. Your house doesn’t put money in your pocket, it’s a liability. A investment property (if done right) can put money in your pocket and has tax benefits. The family home could wait.

This book cemented the idea we should invest in real estate. But there were other financial goals we needed to kick first.

Pay Yourself first

Robert’s poor Dad paid everyone else first and paid himself last. Rich Dad said pay yourself first. I took this onboard. Our investment account was the first to get it’s share of our income.

Investment Account

I wasn’t sure where to invest but it needed to beat inflation. Long term investing was the strategy and the stock market was appealing.

After thorough research I felt comfortable investing our money in Exchange Traded Funds (ETFs). I needed an online broker and for me SelfWealth came out on top after comparisons.

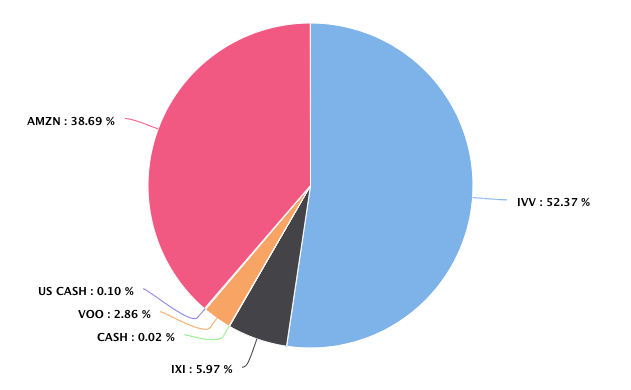

We managed to push a sizeable amount (for us) into the investment account over the past year using the dollar-cost averaging strategy. Below is a breakdown of our holdings by stock market ticker symbols. I plan to up IVV and IXI over the next year as my ratios are not where I want them to be. And yeap I know there is overlap between IXI and IVV. I believe IXI provides hedging during a recession when the S&P 500 index will under perform - that’s my opinion, I’m not a financial advisor.

Is it risky holding individual stocks? I am comfortable holding AMZN for the long term because of my stint working for them.

The stock market performed well last year and on paper we made around $3,600. But wins or losses are only locked in when you sell. There will be years of negative returns and we are comfortable with this. It’s about time in the market not timing the market.

Emergency Fund

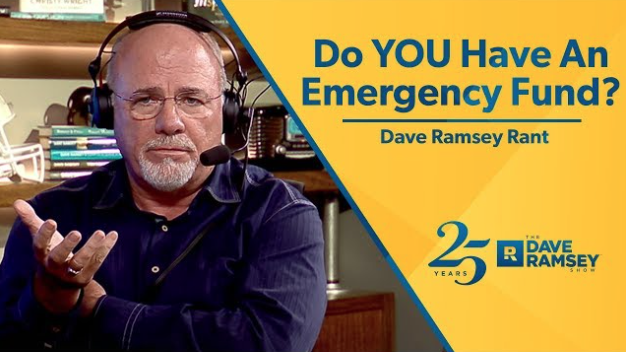

Last year I started watching content from Dave Ramsey. I don’t agree with everything he says but I do agree with having an emergency fund. My Dad’s comment on “Having money gives you options” was essentially the same thing.

With this in mind we set out to save 6 months of living expenses in cash. We achieved this milestone last month. Inflation will erode this cash surplus but you can’t have your cake and eat it too.

I feel better knowing we have cash on hand for emergencies. The money sits in a high interest savings account that earns 5% pa if the balance increases every month.

SuperAnnuation

I like to complain about the creative ways the government taxes me. But I will give them credit for forcing me to save into a Superannuation fund. Because of this my super balance is healthy for my age.

Back in 2008 I knew nothing about super and didn’t care. I went with my employers default fund. 4 Years ago that fund closed due to under performance and I was shifted to another fund.

I never paid attention to my super except to see my balance intermittently. Recently I looked closer and found my existing fund under performed compared to other super funds. To top it off my fees were around 1.3%. I read somewhere if your super fees are higher than 0.85% you should look to move elsewhere.

I moved my super to Australian Retirement Trust. Their track record of returns and lower fees put my existing fund to shame. There are always risks with investing but fees are something I can control. Hopefully future Sander will thank present day Sander for awakening our super.

Books

Lately I’ve been reading finance books. It started with personal finance but has branched out.

Below are a few books I’ve read in the past few months:

The Trading Game by Gary Stevenson. I found Gary’s story from poverty to earning millions as a trader fascinating. His YouTube channel is Garys Economics. The content is thought provoking and easy to follow for newbs like me.

Retirement made simple by Noel Whittaker. This was a recommendation by a family member. Really good read to prepare for retirement in Australia. I liked the real world stories he provided. One of my takeaways was to engage a good financial planner.

30 Properties before 30 by Eddie Dilleen. Great read of how a young man from Mount Druitt with essentially nothing built up a portfolio of 30 properties before 30. It’s an inspiring tale and he shares the numbers behind his properties. Great for a wannabe property investor like me.

Central Banking 101 by Joseph Wang. Not gonna lie and pretend I understood everything in this book. I had been looking into the 2008 global financial crisis and how the Fed (Central Bank) printed money to bail out Wall Street. I wanted to know more about central banks. The book answered my questions and I learned a few things.

Financial Goals

There is much I need to learn and do. My ultimate goal is to build wealth that each Veenstra generation will grow and pass on.

We’ve set an ambitious target to grow the share portfolio. If we achieve it our reward will be a beautiful walnut entertainment unit we’ve wanted for years!

![]()

If you see this in our lounge we hit one of our investing goals!

Our next goal is to purchase an investment property in 2-3 years but there is no rush. We will use a buyers agent. The experience they bring will be invaluable to newbs like us.

What about an owner occupied property? For now I am content to rentvest. This could change in the future but rentvesting makes sense for now.

I want to impart good financial fundamentals to my children like my parents did for me. I also want to educate them on investing. My oldest has an Amazon share he can cash out at eighteen. Home RSUs!! He asks me every now and then what the price is. When he turns eighteen I hope he is wise enough to let it keep compounding.

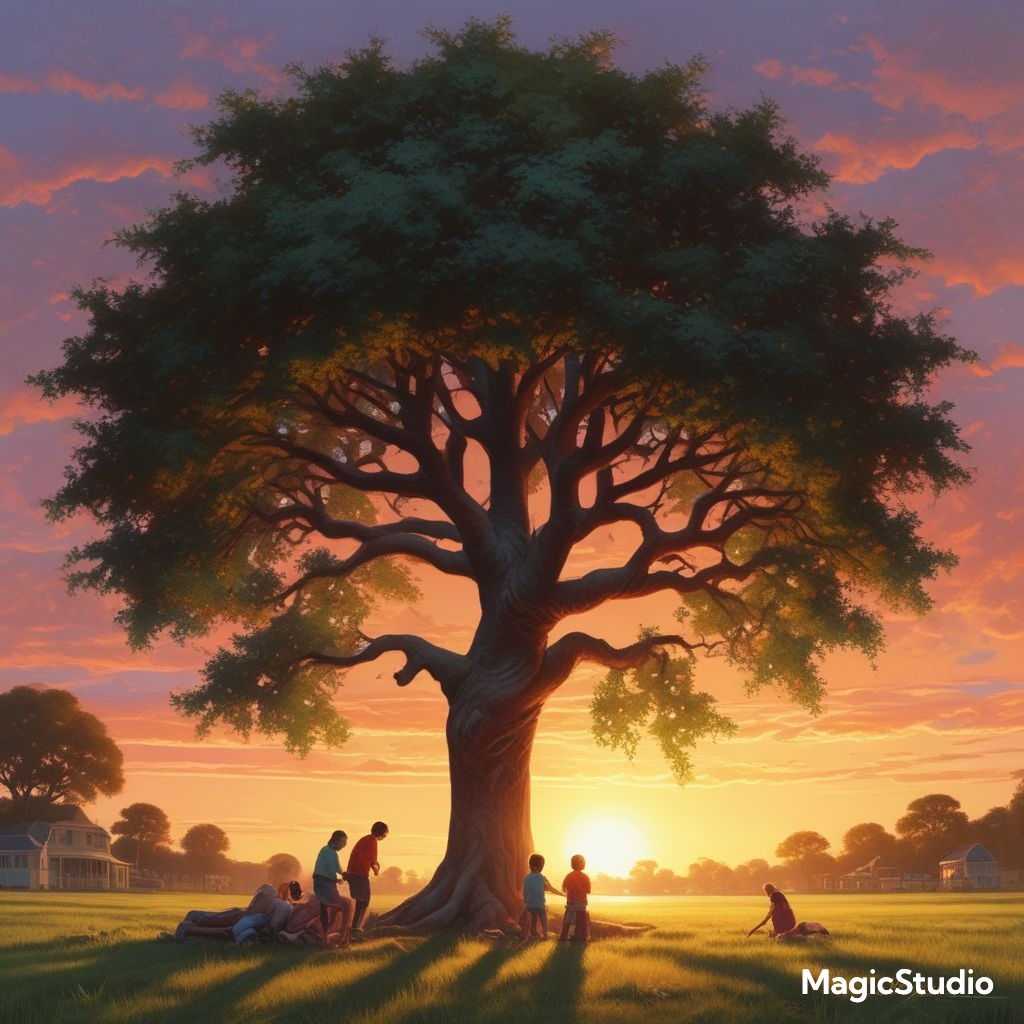

I squandered my best asset when it came to investing. Time. The best time to start investing is now. I hope the seeds we plant today grow into magnificent trees. If not for us then for our children and their future generations.