We did it!

Achieving our first investment goal!

Our Target

In early 2023 I started taking our finances seriously. Expenses reviewed, costs cut, budgets made and tweaked!

We were in our early 40s with 3 young children, calling Australia’s most expensive city home. It felt like I had left things too late.

“The best time to invest was yesterday. The second best time to invest is today” - Warren Buffett

The above quote reminded me I cannot change the past but with deliberate steps now we could control our financial future.

In a previous blog post I explained our long term investing strategy using Exchange Traded Funds (ETFs). The target was to grow our share portfolio to $100,000 AUD by 2033 (10 years).

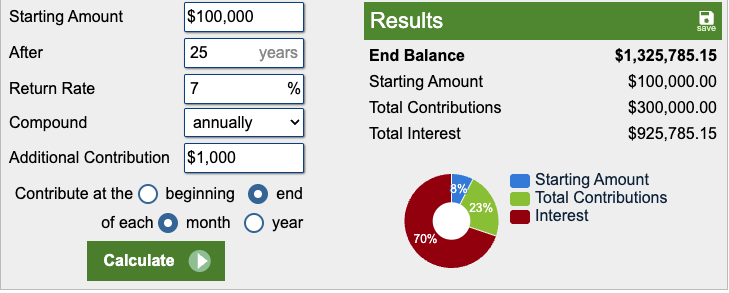

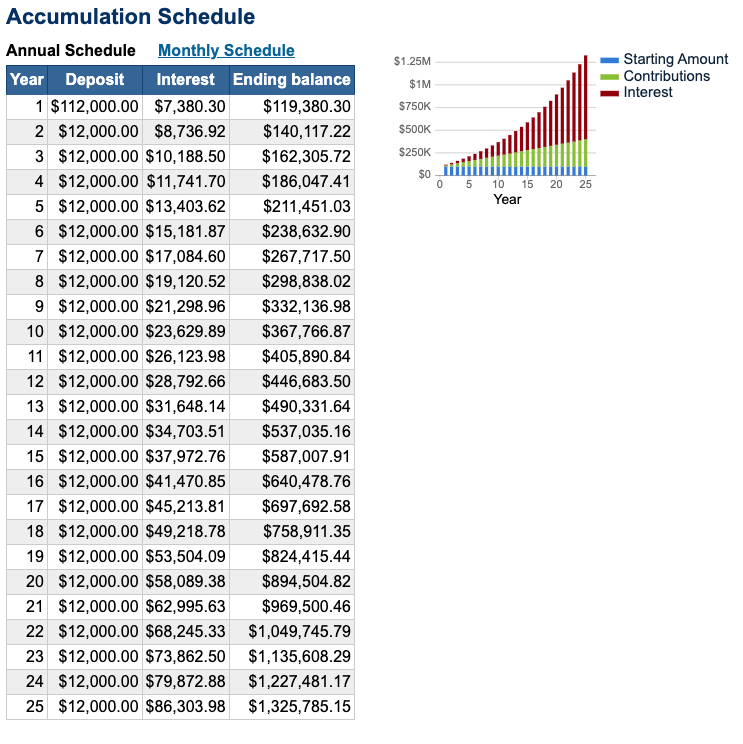

Why $100k? There are plenty of YouTube videos and articles that glamorise wealth exploding after $100k. Wealth doesn’t explode beyond this figure. The simple fact is compounding interest can be seen working faster after $100k.

Below are screenshots from an investment calculator, assuming a conservative 7% return (S&P500 has averaged ~10% return over last 100 years) and depositing $1000 per month could result in over $1.3 million dollars.

Focussed Saving

In a previous blog post I hinted at our ambitious target. For us $100k was an achievable goal within 2-3 years but required discipline to achieve.

We saved any extra money which shaved years off the initial 10 year plan (commission payments, stock vests, Uber driving, excess money in budget etc)

Life still happened and emergency expenses popped up. Our car needed a new AC unit, engine mounts, engine seals, brakes etc. Rach and I both needed a lot of dental work. Theo broke his arm and other small things popped up requiring cash.

Thankfully we had our emergency fund which provided a buffer so we could continue to squirrel away money.

The result? Our emergency fund is almost drained but it did it’s job and meant we never had to sell our investments. And yes we are building up the emergency fund again.

Target Achieved

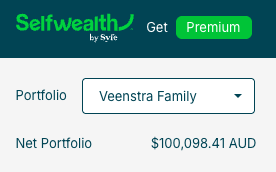

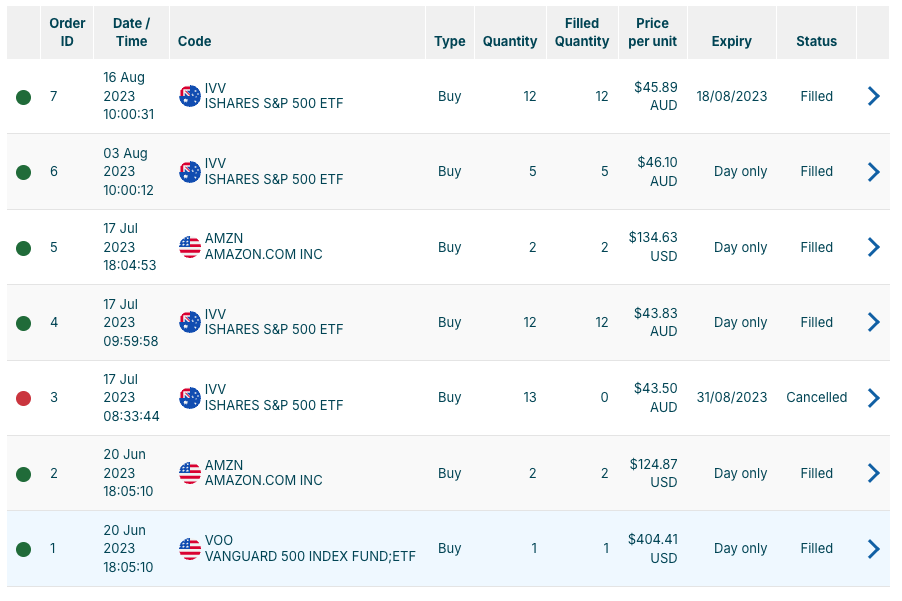

We hit our $100,000 target on 13 June 2025, eight years ahead of our initial schedule.

The first share purchase was 20 June 2023, it took us just under 2 years to hit our goal.

Reviewing the numbers we contributed ~$94,500 and to date ~$5,500 is from growth. In Feb 2025 we were tantalizingly close to $100k with over $10k in growth. Why the decline in growth?

In March 2025 the US implemented tariffs with other countries which shook the market. Our investment account took a massive hit and we lost the entire $10k growth plus some of our own capital.

For us it’s about time in the market. Not timing the market so we never panicked and sold.

Below is a snapshot of our current holdings. We went all in with the S&P500 (IVV) chasing growth not dividends. My suspicions were confirmed regarding IXI. When the US tariffs tanked the market IXI did fall. But it continued to grow (albeit slowly). People still need their everyday consumables!

Free Shares

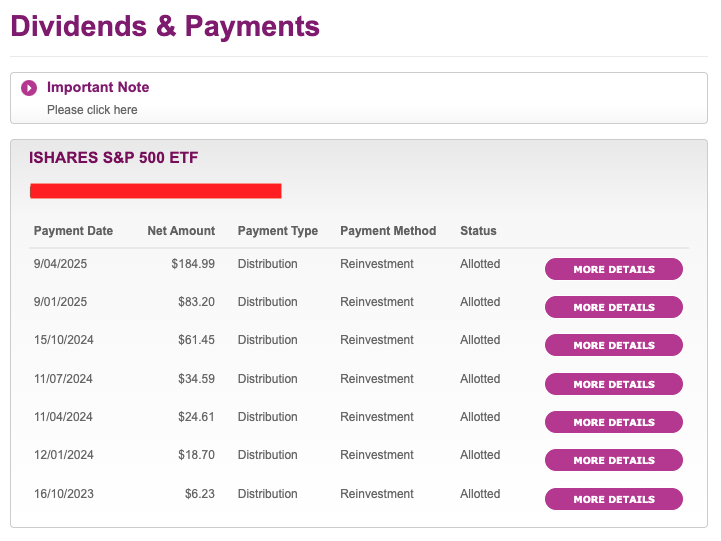

A bonus to owning more IVV shares is the dividend payment each quarter. Our dividend payments are set to “Dividend Reinvestment Plan” aka DRIP. This means the money is accrued until there is enough to buy more shares.

Below is our statement from ComputerShare (Share registry company). The dividends increment slowly as the account grows.

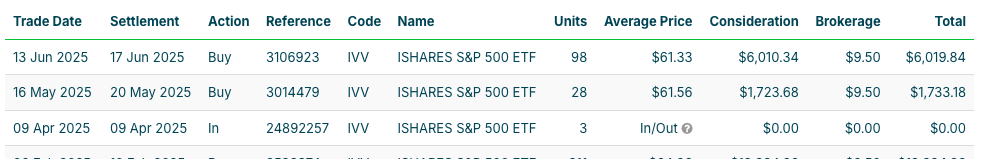

In April 2025 we received $184.99, the IVV share price was around $61 which was enough to purchase 3 extra shares. The shares are automatically purchased without any brokerage fees - Sweet!

Below is a screenshot of the 3 shares hitting our SelfWealth account on 09 April 2025.

IconByDesign, our Reward

We wanted to reward ourselves if we hit the target. Our reward was this beautiful Walnut Entertainment Unit from IconByDesign. We saw this unit over 5 years ago but it was expensive. It was difficult to justify the cost. This was the perfect reward if we hit our target early!

I will post a picture of our living room once it arrives.

Update 20/06/25 - Unfortunately we needed to delay our reward purchase. We got hit with ~14k bill from Centrelink for overpaid childcare subsidies from 2020! 😱

Future Goals

My financial goals have changed since last year

- Keep the investment account ticking along

- Make voluntary super contributions

- Grow the children’s investment accounts

- Open Super accounts for the children & make voluntary contributions

- Purchase a family home

Recently we visited Brisbane and it opened my eyes to houses we could afford. The plan is to save hard for the next 2-3 years and perhaps purchase our forever home.

The itch to own our own property has been growing inside me. I am tired of the constant rental increases in Sydney. Unless we win Lotto affording a property in Sydney (in a desireable suburb for us) is unattainable. Even if we managed to stretch for a huge mortgage I think the stress would be too much.

Life can be fickle and things will change. If the house doesn’t work out I will take comfort in wise words of my pops:

“Having money gives you options”