Free $500 from the Australian Government

How my wife gets $500 dollars per year for retirement - tax free

Superannuation

If you’re not familiar with Australian Superannuation I recommend reading the Australian Taxation Office (ATO) Superannuation Basics.

In a nutshell your employer is required to pay 11.5% of your earnings (increasing to 12% in 2025) into a super fund of your choice. The fund invests the money and at preservation age you can access the funds (60-65).

My employer pays super on top of our negotiated salary (I am blessed). My wife’s super came out of her negotiated salary when she was working full time 😟

Recently I’ve been on a mission to overhaul the families finances and investment strategies. While researching new super funds I came across this little gem.

Super Co-contributions

The co-contributions are for low or middle-income earners who make personal non-concessional (after tax) contributions to their super. The government may also make a contribution up to a maximum of $500. 😎

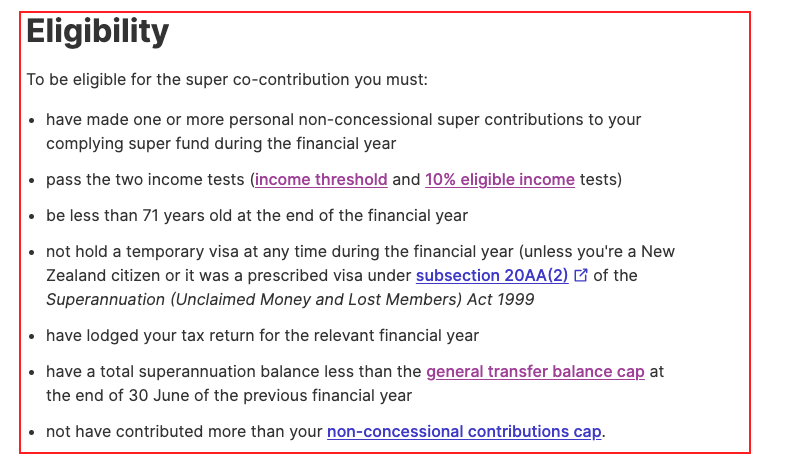

The ATO has published everything you need to know about co-contributions here including eligibility requirements:

My wife doesn’t work full time currently. She works a few hours a week keeping books for a barrister and earns a small income from pamphlet deliveries. She is well under the Lower Income Threshold for the co-contribution which is $43,445 in 2024.

I checked Rachel’s other eligibility requirements and she meet all requirements except one: one or more personal non-concessional super contributions….

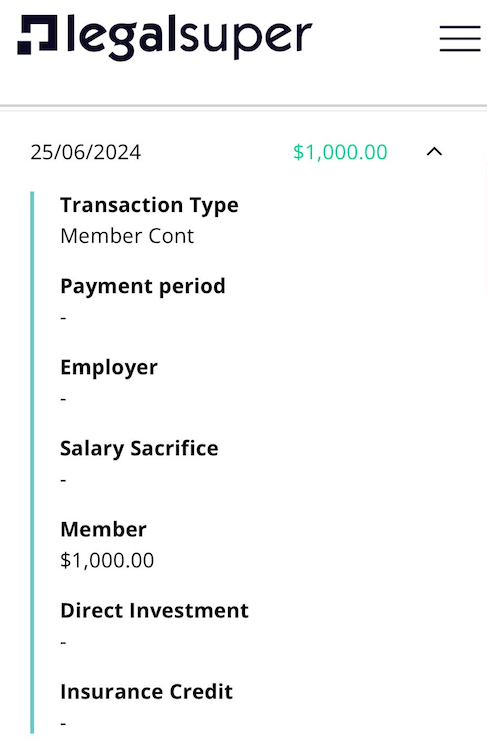

This meant she needed to transfer money into her super post taxes. We were fortunate to have $1000 to transfer into her super fund just before the financial year end to qualify. She made the payment on 25/06/2024.

There is a Super co-contribution calculator available to estimate the government contribution based on your post tax contribution.

There was one last step to complete.

Last Step

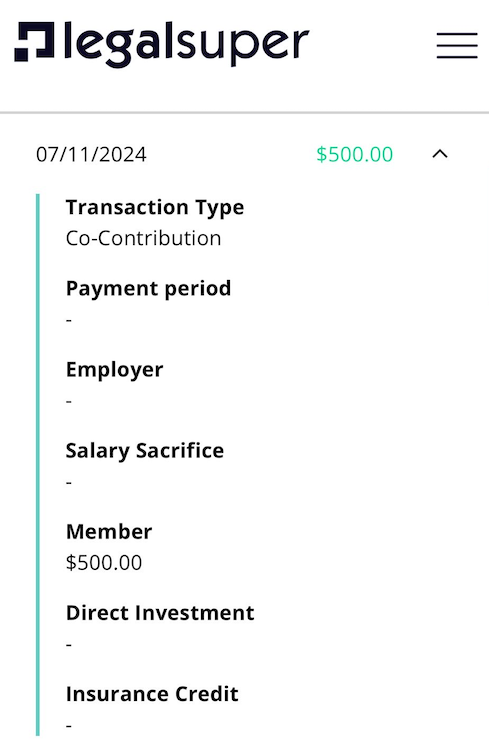

Submit tax return! Rachel submitted her tax return on 31/10/2024. That made her eligible for the co-contribution. This was the first year we tried this so we waited.

We didn’t need to wait for long. On 07/11/2024 the government put an extra $500 in her super fund 🥳

Conclusion

My key takeaway was I should probably hire an accountant who would be all across this stuff for our next tax return haha!

Let’s be real $500 is not life changing money but it’s free and will help Rachel’s super compound. I think it’s great for mums (and Dads) whose primary role is looking after the family. They might have a little side hustle and earn under the threshold. If they contribute to their super (post tax) the government will give their super a little boost.

Anytime the government gives you something for free, I say “cheers” to that!