From Little Things Big Things Grow

Kick starting our children’s investment accounts

The Itch

Personal finance has become a passion for me. I’ve been devouring investment and financial information like a Klingon leaping into combat.

Long term investors know time is key for investments to grow. My children have time, loads of it.

What if we planted a small investment seed for them? And more importantly where would we plant that seed?

The Seed

We set aside $1500 ($500 each) to get them started. To nurture their seedlings we will add $1000 to each account per year.

Planting the Seed

What about banks? A kid’s fee free account would generate around 5% interest.

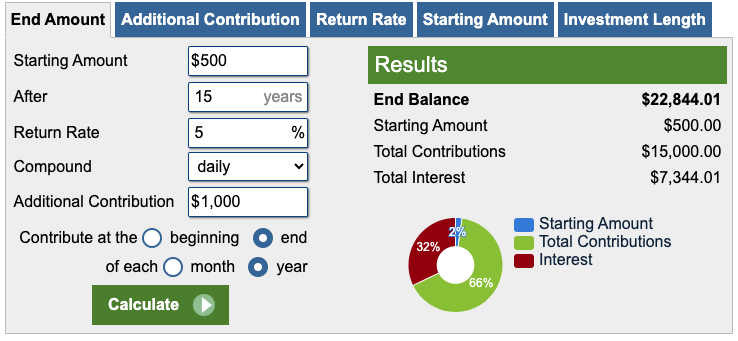

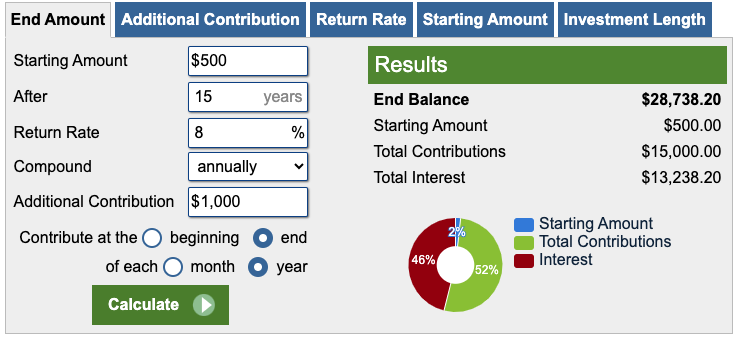

Let’s plugin some variables into an investment calculator:

- $500 starting amount

- 15 year investment period (my youngest is 6, maturity at 21 Years old)

- Interest rate 5% (calculated daily)

- Additional contributions $1000 per year

To be fair it’s a decent return for a no risk option. Handing over the keys for $22,841 would be a decent start to Elliot’s investment journey.

But we wanted to provide assets to our children. A bank deposit is not an asset. It doesn’t appreciate in value because it doesn’t generate anything. Yes, we understand it gains compounding interest over time.

That left stocks or property. An investment property is not a passive investment and requires leveraging debt (not part of our immediate investment plans). Each child would be tied to the same property, what if one wants to cash out?

Stocks

For us stocks was the answer. Stocks are assets that CAN appreciate in value and some pay dividends. Which stock did we select?

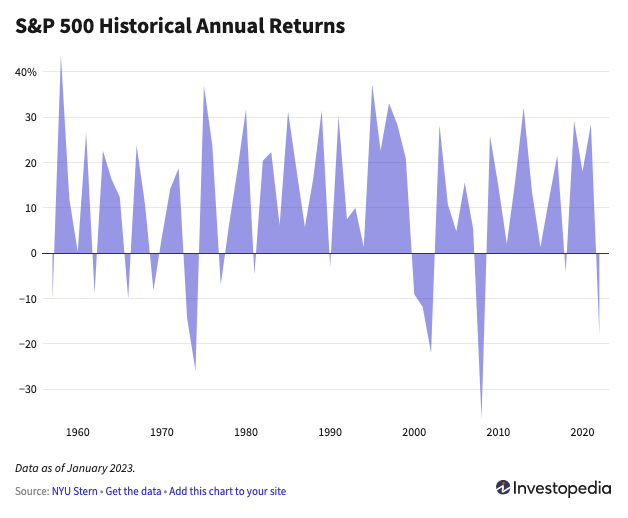

The Standards & Poor’s 500 Index (S&P500) tracks the 500 leading publicly traded companies in the U.S. The index has an impressive track record, 10% average return since the index was created in 1957.

Investing directly into the S&P500 is not possible. It’s an index created by Standards & Poors. But you can purchase ETFs (Exchange traded funds) that track the S&P500. What does this mean?

Simply put, an investment company buys a basket of stocks that mimic the S&P500 called an ETF. The ETF is traded on the stock market like other stock. Purchasing an ETF means you own a small slice of the basket and therefore a small slice of each stock in the basket (the top 500 US listed companies).

Other advantages:

- Low management fees, typically around 0.04%

- Diversification

- Dividend Payments

- DRIP (Dividend Reinvestment Plans)

Let’s run the same numbers into the investment calculator. The S&P500 historically returned 10% on average but lets be conservative and put in 8%. We will set the compound setting to annually to give the bank deposit the edge.

This asset should return an additional $5894 over 15 years vs bank deposit. The trade off is risk. The S&P500 chart showed there were negative return years. I see this as low risk as we are investing long term.

If the top 500 US listed companies go belly up something catastrophic happened in the world. We will have bigger concerns than our children’s investment accounts.

There are many ETFs that track the S&P500, which one to choose?

Which ETF?

Initially we looked at Vanguard S&P500 ETF aka VOO. There were 2 problems:

- VOO at time of writing trades for $526 USD ($772 AUD), more than our budget

- VOO is domiciled in the US, foreign exchange fees would apply

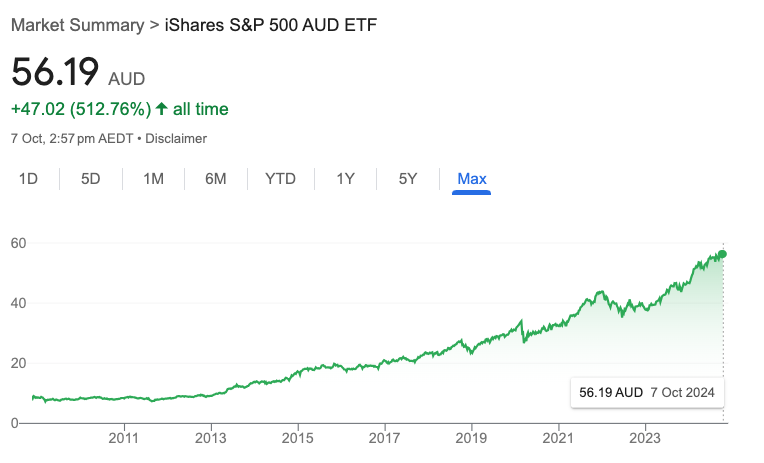

We selected BlackRock iShares S&P500 ETF aka IVV:

- IVV domiciled in Australia

- IVV can be purchased on the Australian Securities Exchange (ASX)

- IVV trades for $56 at time of writing (thanks to a 15 to 1 stock split in 2022)

- IVV low management fee 0.04%

- IVV Holds over 8 billion dollars in assets tracking the S&P500

The fund has a track record of growth, not surprising as it’s tracking the S&P500.

Which Broker?

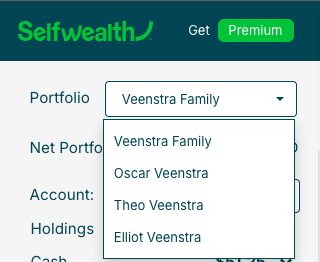

We are already investing with Selfwealth, they are CHESS ASX sponsored, reliable and we’ve never had issues. It made sense to stay with them. They are not the cheapest on the market but we are ok to pay the $9.50 per trade. It would be nice if kid’s accounts had a discount on their fees.

Three accounts were setup under our login. The registration process required copies of birth certificates and the accounts were activated a few days later.

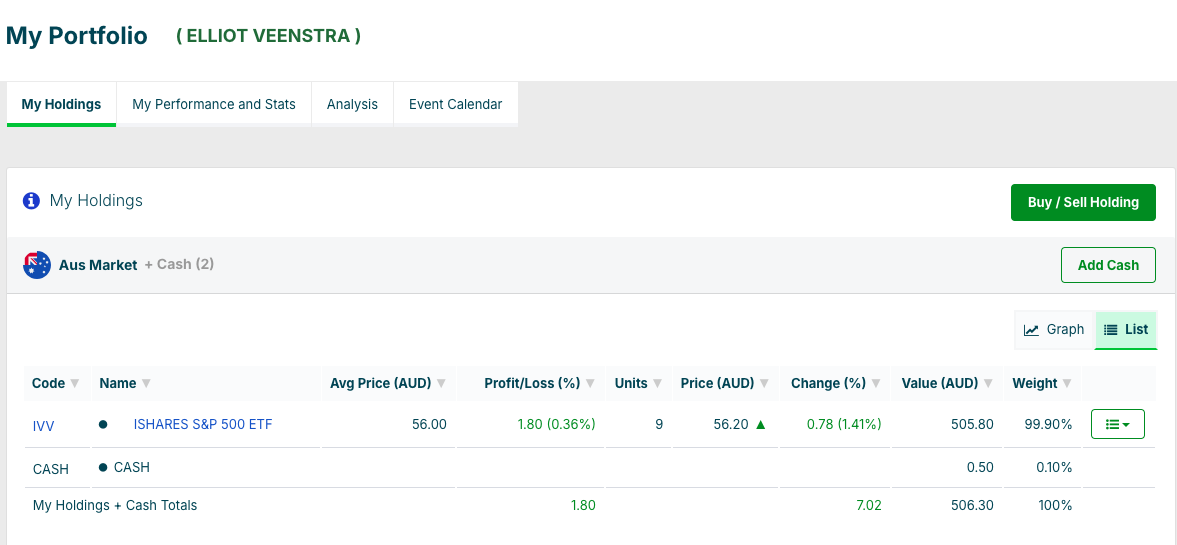

We purchased $500 of IVV stock for each child, if we ignore the trading fee each account is up $1.80. It’s fluctuated the last few weeks, some days their accounts were in the red. But long term we are confident their accounts will grow.

IVV does pay a small dividend each quarter which we set to Dividend Reinvestment Plans (DRIP). DRIP means iShares holds dividends and automatically buys more stock when the accrued amount is high enough. Don’t forget to declare the dividend income to the tax man. He will charge your marginal tax rate on dividend payments despite never receiving the funds.

Stocks are assets and therefore subject to capital gains tax (CGT) when sold. Our children will be eligible for a 50% CGT discount as the stock will have been held for over 1 year.

Conclusion

As a parent we are helping our children maximise their best investment asset……. time.

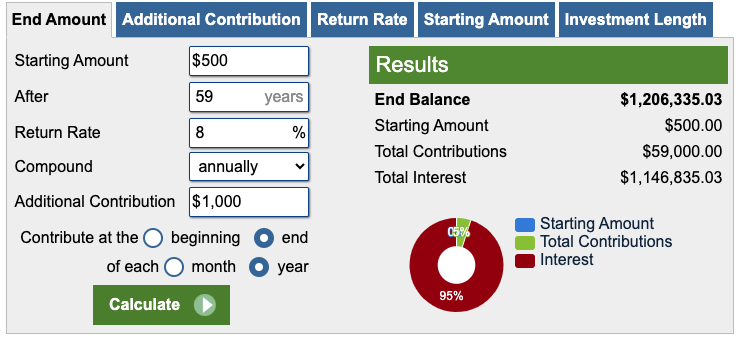

If Elliot continues to squirrel away $1000 per year until 65:

He will have $1.2 million dollars of which $1.146 million (95%) will be appreciation!

Some might say $1.2m will be nothing by the time Elliot is 65. Yes that amount won’t have the same purchasing power as today due to inflation.

My response is:

- He will be $1.2m wealthier vs doing nothing

- He will likely contribute 1k+ per year which means greater returns

He might choose to cash it out one day to assist with a house deposit. If the actions taken today help our children in life we have achieved our goal.

What if they cash it out and squander it? That’s on them and we’ll take responsibility for not instilling better financial fundamentals.

For now we are happy to have planted their investment seeds and watch them grow.