Why I left one of the Big Four Banks

Why I left Westpac and opted for a branchless bank

A Known Brand

In 2008 I opened an account with Westpac. The brand was familiar (coming from NZ) and one of the big four banks in Australia.

Westpac had a branch within walking distance where I first lived in Sydney. I used the branch twice in 16 years, once to open an account and once to close my accounts.

Australia Royal Banking Commission

In 2017 Australia launched a Royal Commission for misconduct in the Banking, Superannuation and Financial Services Industry. For the average Australian it highlighted what everyone knew. Banks were fleecing customers. Westpac did not emerge unscathed and a few years later they were in the spotlight again.

Did this prompt me to change or investigate other banks? Nope

What triggered change? My Uber driving planted the seed for change.

Uber Driving

Back in Dec 2023 I started Uber driving. I wanted to keep Uber finances separate for tax purposes. Fees became important. I didn’t want my meager Uber earnings eroded by bank fees.

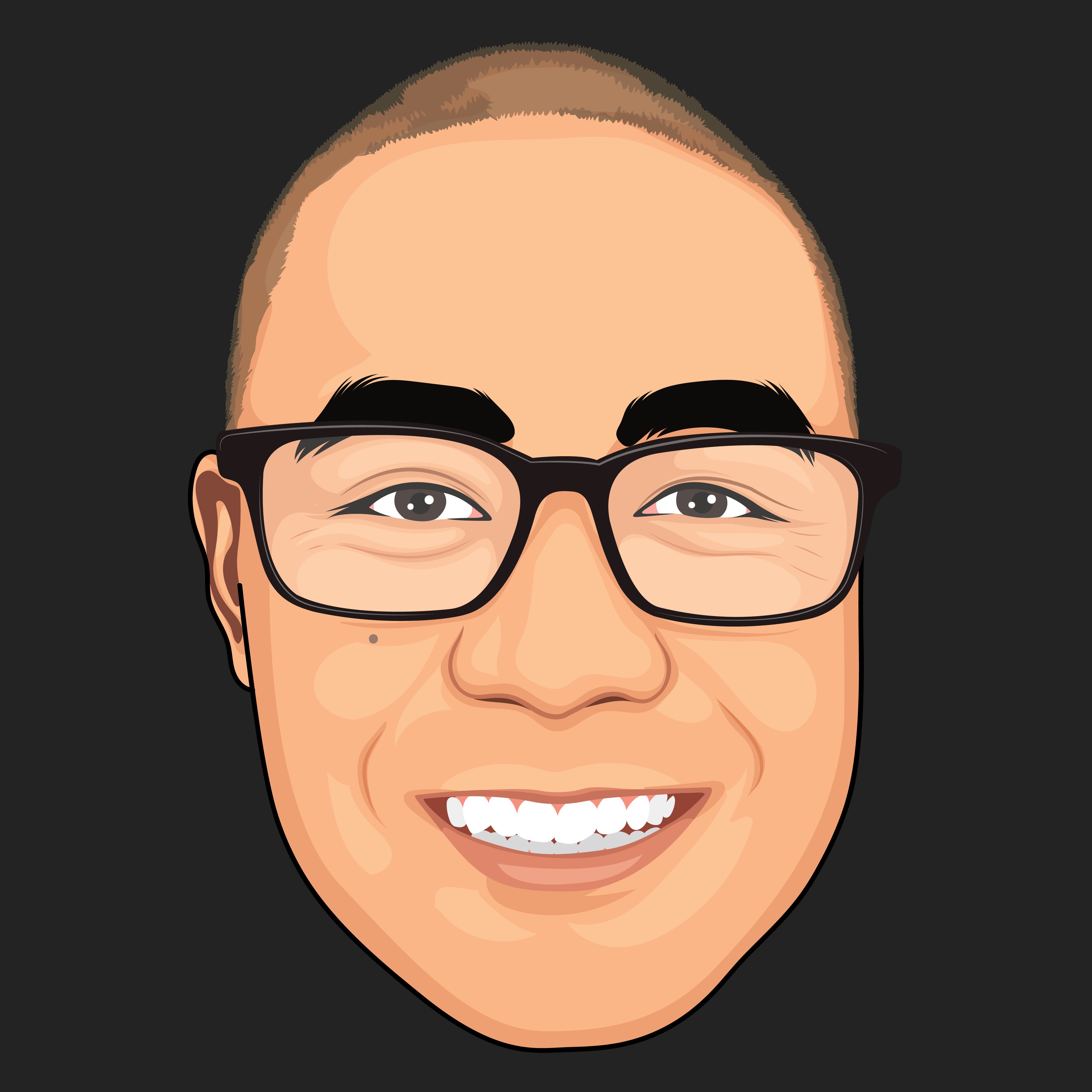

The ING Orange Everyday account stood out. Basically there are no fees. There are fees for expedited bank cheques and international transactions, not something I use.

The Barefoot Investor

Opening an ING Orange Everyday and Savings Maximiser account revealed a new way of banking….well at least for me.

Banking with little to no fees.

I started comparing Westpac fees. It wasn’t too bad. I was exempt from most fees because I deposited above the required threshold each month. But the potential for fees was there, something I would soon discover.

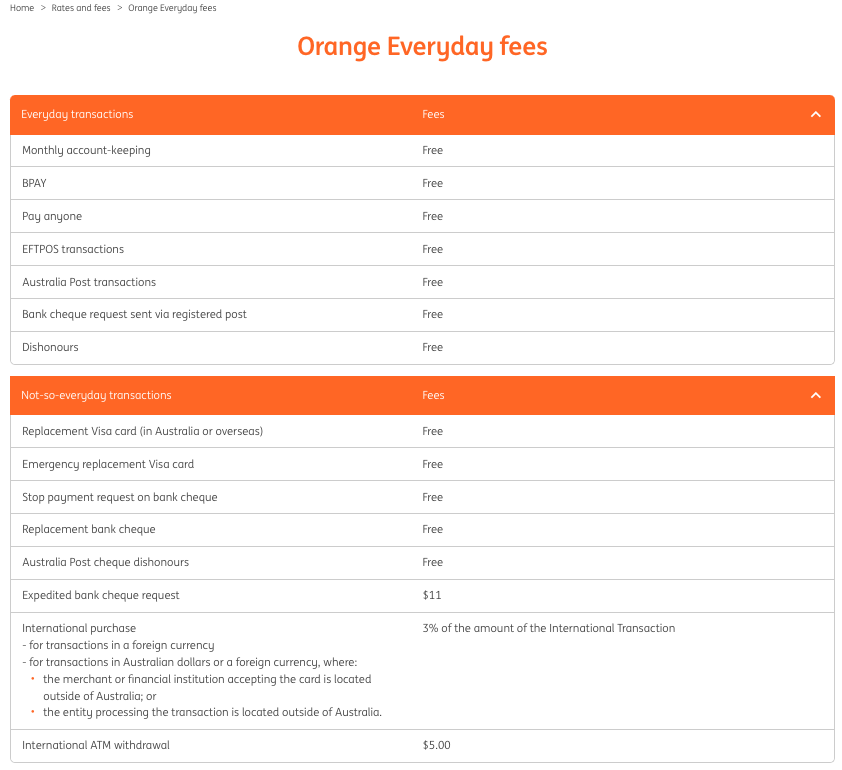

A few months ago I devoured another financial book The Barefoot Investor by Scott Pape

Scott is a fan of ING but he revealed something else. I thought my money was safe because I banked with a big bank.

He highlighted the Australian Financial Claims Scheme (FCS). In a nutshell the government provides protection of up to $250,000 per account holder for deposits helds in specific financial institutions. That same FCS scheme covers ING so my money was just as safe.

The Final Straw

In June I received a Broadcom stock allocation. My previous employers used Morgan Stanley where I could transfer money to an Australia account (there were fees but back then I didn’t care).

Broadcom use Fidelity. Fidelity do not support international transfers. To get around this I opened a Westpac Foreign currency account online.

How does it work?

- Fidelity transfers money to a US bank that has relationship with Westpac

- US intermediate bank transfers money back to Westpac Australia

- Westpac Australia transfer USD into my foreign currency account

- I choose when to convert the money into AUD

- I accept the Westpac currency conversion rate plus pay a fee

Westpac took around $1000 AUD exchanging from USD. I think the amount is excessive.

This is a first world problem and know I am insanely blessed to be complaining about this

I hunted for alternatives, there had to be cheaper way to transfer and exchange foreign (FX) currency.

Revolut to the Rescue!

Revolut is a cost effective service with great reviews online.

Below is brief breakdown of how it works:

- Revolut allows customers to setup accounts in different currencies

- Fidelity can transfer directly to my Revolut USD account

- I choose when to exchange USD to AUD

- AUD funds can be transferred to an Australia Bank Account

- The entire process is done via a phone app!

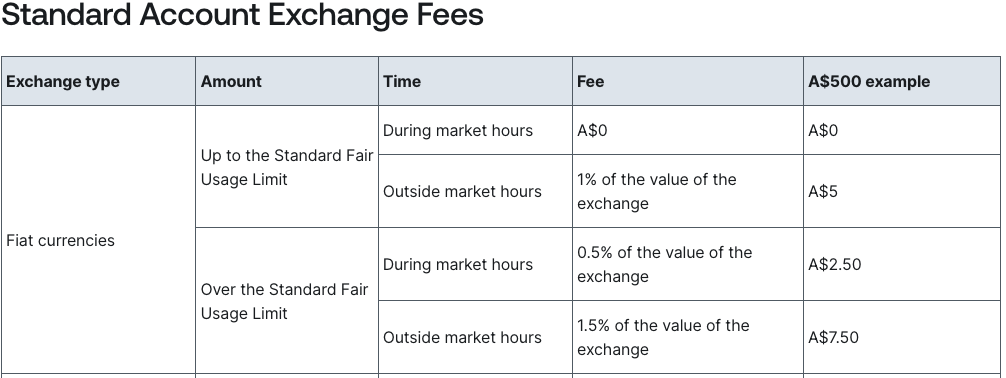

Revolut’s exchange rate favours the customer. If you convert less than $2000 AUD per month there are no fees. This has been fantastic when transferring smaller amounts of money between Australia and New Zealand.

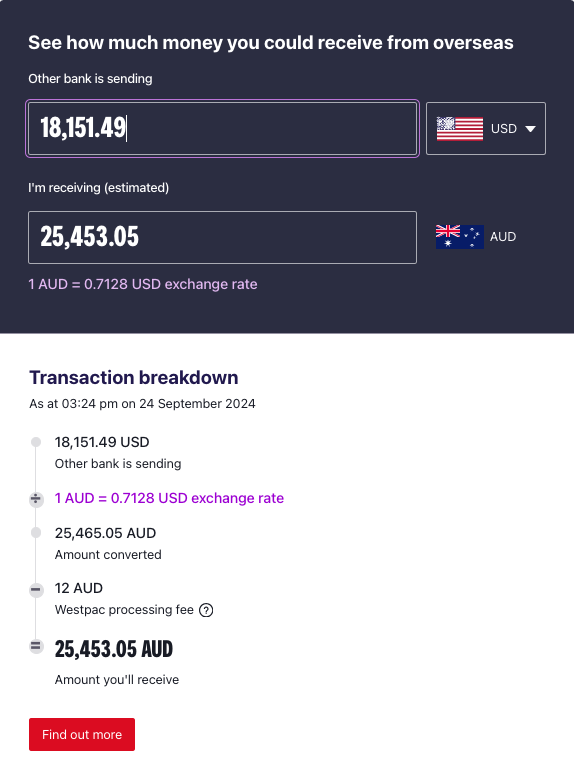

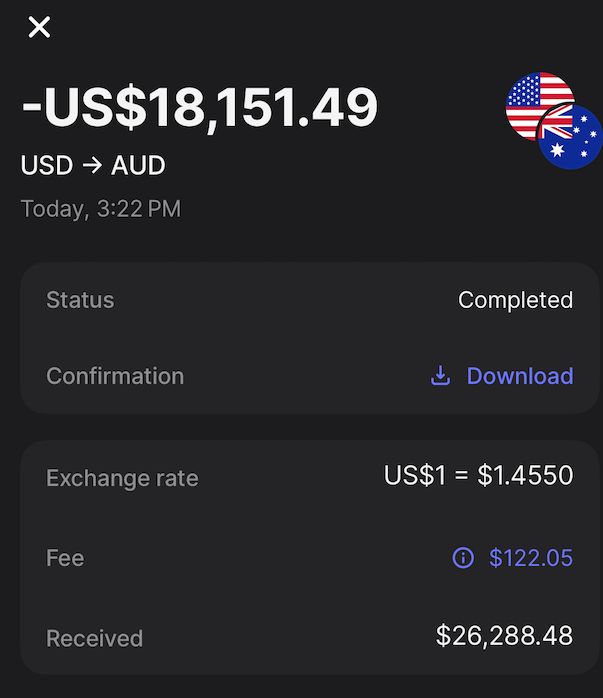

Let’s look at a real example and run through the numbers. I recently sold some stock and had $18,151 USD in my Fidelity account.

I like to plug the USD value into Google so I know the AUD equivalent without fees. Unfortunately I forgot to take a screenshot at the time.

I exchanged USD to AUD at 3:22 PM AEST or 05:22 UTC. The screenshot below shows the exchange rate 1 minute before. Therefore we can calculate (roughly) what the value was.

$18,151 USD x 1.4568 = $26,442 AUD.

At 3:24PM AEST I plugged in the numbers to Westpac’s currency converter calculator. $989 disappears during the conversion.

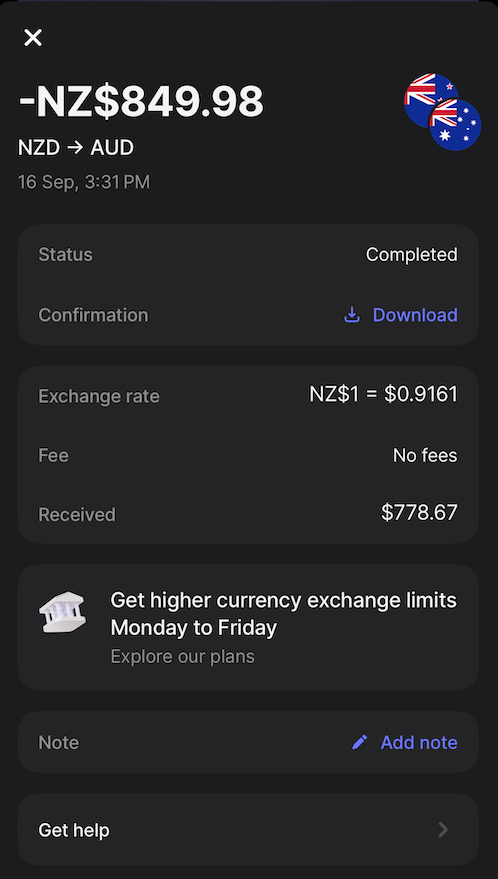

Revolut also has a currency converter calculator. Rather than use this calculator lets look at what I was charged. Don’t forget Revolut do charge fees. There are extra fees for FX changes outside of market hours.

Below is screenshot of my Revolut conversion. The conversion rate was far superior to Westpac and their fees. I saved $835 using Revolut!!

My fees were even lower because I had not used up my $2000 AUD allocation for the month

Bye Westpac

I could now close my Westpac accounts. This wasn’t easy.

First I tried to close my foreign currency account. There was no online or telephone option, I filled in a form and dropped it into a branch close to my son’s school. A few days later it was closed.

Next I needed to close my Westpac transaction accounts. Again the online or telephone options were not available. I found a Westpac account closure page with a QR code that unlocked a hidden option in online banking to close accounts.

I followed the process and it took about a week for 2 accounts to be closed. The other two accounts went into negative as fees were debited as part of the closing process. Why the fees? My pay was being deposited into ING so there was no exemption for fees. I put the accounts into positive and submitted two more account close requests.

Tired of waiting with the chance of paying more fees I visited the branch where I opened my account 15+ years ago. The teller advised the accounts could not be closed. The online requests I submitted needed to run their course. About a week later the remaining 2 accounts were closed.

Conclusion

My recent interest in personal finance had me questioning a lot of financial decisions.

My bank loyalty was never rewarded and in my opinion they don’t care unless you have a significant amount saved with them. I found it amusing when Rachel got unsolicited calls from Westpac about managing her wealth. Rach holds our savings account and I transfer her regular deposits. I never got calls.

Going forward I will look to move our credit card to ING and savings account (they offer 0.5% more per annum than Westpac).

I encourage others to look into their banks. There are options out there beyond the big four covered by FCS scheme. For services like FX there are secure cost effective options not tied to traditional banks.

Why should I contribute to one of the Big Four’s profits for not a lot in return?